4 7: Closing Entries Business LibreTexts

Distributions has a debit balance so we credit the account to close it. Our debit, reducing the balance in the account, is Retained Earnings. An accounting year-end which is not the calendar year end is sometimes referred to as a fiscal year end. For partnerships, each partners’ capital account will be credited based on the agreement of the partnership (for example, 50% to Partner A, 30% to B, and 20% to C).

- You see that you earned $120,000 this year in revenueand had expenses for rent, electricity, cable, internet, gas, andfood that totaled $70,000.

- The accounting cycle involves several steps to manage and report financial data, starting with recording transactions and ending with preparing financial statements.

- All the temporary accounts, including revenue, expense, and dividends, have now been reset to zero.

How to post closing entries?

In other words, the closing entry is a method of making repayments on all the costs incurred within a given financial year. To complete, this method involves transfer of funds from revenue-generating accounts such as wages payable and interest receivable to an intermediary account known as income summary. Therefore, we can calculate either profit margin for this company or how much it lost over the year. The permanent accounts in which balances are transferred depend upon the nature of business of the entity. For example, in the case of a company permanent accounts are retained earnings account, and in case of a firm or a sole proprietorship, owner’s capital account absorbs the balances of temporary accounts. This means thatit is not an asset, liability, stockholders’ equity, revenue, orexpense account.

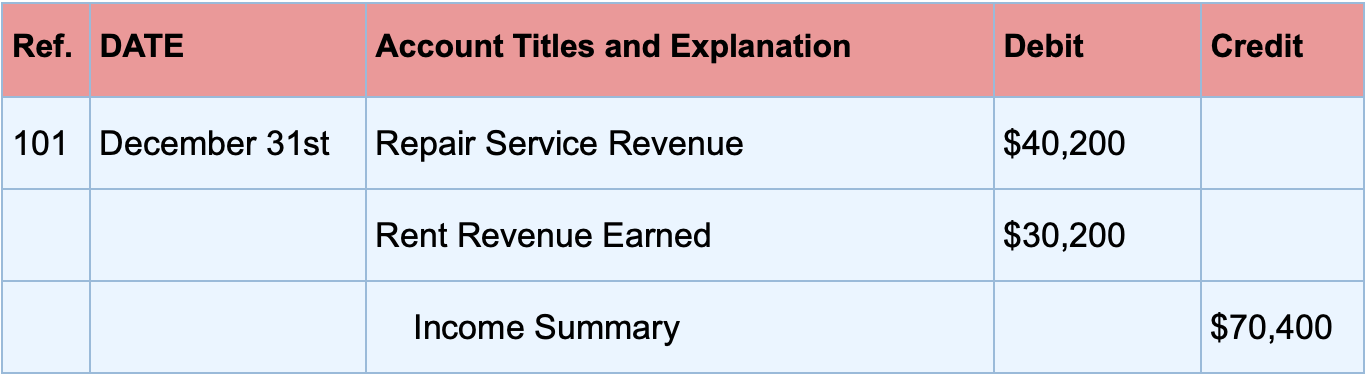

Use of an Income Summary Account

You must debit your revenue accounts to decrease it, which means you must also credit your income summary account. You need to create closing journal entries by debiting and crediting the right accounts. Use the chart below to determine which accounts are decreased by debits and which are decreased by credits.

How to close an income summary account?

If your revenues are less than your expenses, you must credit your income summary account and debit your retained earnings account. After these entries, all temporary accounts (revenue, expenses, dividends) will have zero balances, and the net income and dividends will be reflected in the Retained Earnings account. Total revenue of a firm at the end of an accounting period is transferred to the income summary account to ensure that the revenue account begins with zero balance in the following accounting period.

It is permanent because it is not closed at the end of each accounting period. At the start of the new accounting period, the closing balance from the previous accounting period is brought forward and becomes the new opening balance on the account. Other than the retained earnings account, closing journal entries do not affect permanent accounts. Also known as real or balance sheet accounts, these are general ledger entries that do not close at the end of an accounting period but are instead carried forward to subsequent periods . Real accounts, also known as permanent accounts, are quite different compared to their temporary equivalents.

This process ensures that your temporary accounts are properly closed out sequentially, and the relevant balances are transferred to the income summary and ultimately to the retained earnings account. In summary, permanent accounts hold balances that persist from one period to another. In contrast, temporary accounts capture transactions and activities for a specific period and require resetting to zero with closing entries.

Create closing entries to reflect when your accounting period ends. For example, if your accounting periods last one month, use month-end closing entries. However, businesses generally handle closing entries annually. Whatever accounting period you select, make sure to be consistent and not jump between frequencies. When you manage your accounting books by hand, you are responsible for a lot of nitty-gritty details.

A hundred dollars in revenue this year doesn’t count as $100 in revenue for next year even if the company retained the funds for use in the next 12 months. ‘Total expenses‘ account is credited to record the closing entry for expense accounts. What is the current book value ofyour electronics, car, and furniture? Are the value of your assets andliabilities now zero direct and indirect expenses examples list pdf difference because of the start of a new year? Your car,electronics, and furniture did not suddenly lose all their value,and unfortunately, you still have outstanding debt. Therefore,these accounts still have a balance in the new year, because theyare not closed, and the balances are carried forward from December31 to January 1 to start the new annual accounting period.

We need to do the closing entries to make them match and zero out the temporary accounts. Once all the adjusting entries are made the temporary accounts reflect the correct entries for revenue, expenses, and dividends for the accounting year. We can also see that the debit equals credit; hence, it adheres to the accounting principle of double-entry accounting. Suppose a business had the following trial balance before any closing journal entries at the end of an accounting period. Both closing entries are acceptable and both result in the same outcome. All temporary accounts eventually get closed to retained earnings and are presented on the balance sheet.